A gateway to the actuarial profession with internationally recognised qualifications

What is an Actuary?

An actuary is a professional who deals with the application of probability and statistical theories to problems in insurance, investment, pensions and financial risk management. The majority of actuaries work for life, health and property/casualty insurance companies, which heavily rely on actuaries’ judgement to ensure their financial security. Other actuaries work for actuarial consulting firms, offering their expertise on financial services, risk management, health care, pension plans and asset/liability management. Other opportunities are available for actuaries in a variety of industries.

Actuaries work with facts, figures and people to solve business problems. They are not only the statisticians of the insurance industry, but also have broader responsibilities in financial management. They frequently evaluate the past, make use of known changes, interpret expected changes and set future directions to determine insurance premiums and retirement benefits.

Actuaries work in many capacities within businesses, consulting firms, government agencies and universities, and often fill senior managerial roles in insurance companies, even becoming senior officers or company heads. Most importantly, all actuaries must have a strong aptitude for mathematics and the ability to apply actuarial knowledge to a range of financial situations.

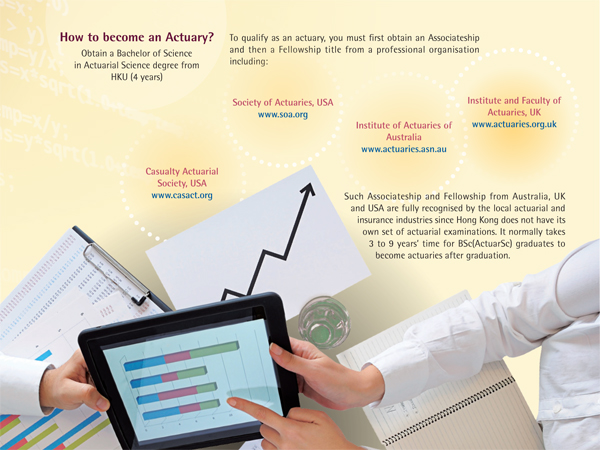

How to become an Actuary?

The Programme

- Provides specialist academic and professional training to students in actuarial science

- Prepares students for professional examinations to Associateship level

UK – Institute and Faculty of Actuaries

North America – Casualty Actuarial Society, and Society of Actuaries - Accredited by professional body, while graduates will be exempted from various professional examinations (subject to re-accreditation)

UK – Institute and Faculty of Actuaries - Validation by Educational Experience (VEE) obtained

North America – Casualty Actuarial Society, Society of Actuaries, and Canadian Institute of Actuaries - Internship opportunities with major insurers, actuarial consulting firms, reinsurers, investment firms, auditing firms, and management consulting firms

Unique Features

- Specialisation: The ONLY programme in Hong Kong accredited by Institute and Faculty of Actuaries

- Professional recognition: The Department of Statistics & Actuarial Science has been designated a Centre of Actuarial Excellence by the Society of Actuaries since 2011

- Career prospects: Given Hong Kong's booming insurance industry and the rapid development of the mainland China market, actuaries enjoy very attractive career prospects. Recent graduates hold positions in major insurance and reinsurance companies, actuarial consulting firms, and investment banks

BSc(ActuarSc) Curriculum Structure (240 Credits)

Forty 6-credit courses spanning over 4 years of full-time study

UNIVERSITY EDUCATIONLanguage Courses Common Core Courses (54 credits) | + | PROGRAMME COREDisciplinary Courses (132 credits) | + | 2nd MAJOR* / |

*Additional credits required

Admissions Talk

Dr Patrick S C Poon Scholarship in Actuarial Science

- 5 scholarships are awarded annually to freshly-admitted first year students with outstanding entrance records, each at HK$50,000 or HK$60,000

- Renewable based on satisfactory performance in each year’s study in the programme

Accreditation

The HKU BSc(ActuarSc) programme is the first actuarial programme in Asia to obtain accreditation from the Institute and Faculty of Actuaries (IFoA), the UK's only chartered professional body dedicated to educating, developing and regulating actuaries based both in the UK and internationally. Students who graduate with a BSc(ActuarSc) degree from HKU with the required marks in specified courses will be exempted from taking various IFoA modules (CS1, CS2, CM1, CM2, CB1, and CB2) as they begin their journey towards qualifying as an actuary.

Internship Programme

Internship opportunities with major insurers, actuarial consulting firms, reinsurers, investment firms, auditing firms, and management consulting firms are provided.

The programme assists students by advertising part-time/summer/temporary or full-time positions, sending to employers resumes of interested students, and assisting students in their preparation for the internships. Recruitment activities normally begin six months or more prior to the expected starting date of a position.

As an intern, the student will gain insight into the challenging world and daily activities of an actuary while increasing his/her technical, analytical and communication skills.

Non-exhaustive list of companies participating in the internship programme:

- CHUBB Life Insurance Company

- AIA Group Limited

- AXA China Region

- BOC Group Life Assurance

- Census and Statistics Department HKSARG

- Ernst & Young

- FTLife Insurance

- HSBC Insurance (Asia-Pacific)

- FWD Life Insurance

- JP Morgan

- KPMG

- Manulife

- Prudential Hong Kong

- PWC

- RGA Reinsurance

- Sun Life Hong Kong

- Swiss Re

- Willis Towers Watson

Career Prospects

Actuaries’ duties are varied, challenging and so important that they are frequently called the “brains” of the insurance business. Given Hong Kong’s booming insurance industry and the rapid development of the mainland China market, actuaries enjoy very attractive career prospects. Recent graduates hold positions in major insurance and reinsurance companies, actuarial consulting firms, and investment banks, including but not limited to:

|

|

The Department of Statistics & Actuarial Science has introduced the Career Advising Programme (CAP) to help students pinpoint their strengths and weaknesses in terms of interview/CV writing skills and better prepare students to seize career opportunities readily. Besides one-to-one tailored consultation on CV and cover letter, the CAP will organise other career-related activities, such as career talks, company visits and mentorship programmes to deepen students’ understanding of the industries.

Student Sharing

Michelle MA

BSc (Actuarial Science) Final Year Student

SHU Tong, Lucien

2020 BSc (Actuarial Science) graduate

“The actuarial science programme in HKU offered me nearly everything I can think of that is necessary and helpful for one to develop and pursue the profession of actuaries – courses closely tied to exam syllabi of actuarial associations, professional skill training sessions, collaboration with actuarial associations and market players, resources for job opportunities, etc. Through the 4-year study and experience, what I have amassed is not merely the theoretical actuarial knowledge and practical working experience, but the connection to the wider actuarial market and the passion to carry on the further pursuit of the actuarial profession.”

CHAN Wing Ho Ronald

2019 BSc (Actuarial Science) graduate

"Being recognized by the Society of Actuaries, the programme is arguably the most prestigious actuarial programme offered in Asia. From what I have learnt and experienced throughout the 4 years of study, it is no exaggeration. It has extensive connections with business institutions from various fields for potential job opportunities. Most students graduate with at least an internship experience and several passed actuarial exams, which give us the edge in job applications and career progression. The programme has equipped me with the essential analytical skills and a wide exposure in actuarial, economic, financial and risk management fields to kickstart my career. The comprehensiveness and thoroughness are unmatched by other programmes in related fields. I am grateful for everything learnt here."